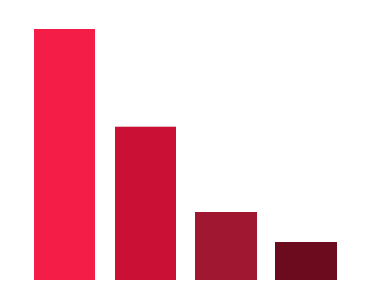

Interest Rate Coming Down

Lowering interest rates on mortgages can have significant benefits for both existing homeowners and potential buyers. For current homeowners, reduced interest rates translate to decreased monthly mortgage payments, offering a chance to save money or reallocate funds to other areas of their finances. It can also create opportunities for homeowners to refinance their mortgages, allowing them to obtain a new loan at a lower rate, potentially reducing the total interest paid over the life of the loan. This increased affordability can bolster homeowners’ financial stability, enabling them to weather economic uncertainties and plan for their future with more confidence.

For prospective homebuyers, lower interest rates make homeownership more accessible and affordable. Reduced rates mean lower monthly mortgage payments, which can expand the pool of eligible buyers and increase purchasing power. This accessibility can stimulate the real estate market, driving demand for homes and potentially increasing property values. Lower rates may encourage individuals and families to enter the housing market sooner, allowing them to invest in homeownership and benefit from potential appreciation in property values over time. Additionally, lower mortgage rates can free up more disposable income, potentially stimulating consumer spending and boosting the overall economy.

Moreover, decreased interest rates on mortgages can have a ripple effect across various sectors of the economy. As more people refinance or purchase homes, there is increased activity in the housing market, leading to greater demand for goods and services associated with homeownership, such as home improvement, furnishings, and renovations. This uptick in economic activity can contribute to job creation and overall economic growth. Additionally, lower mortgage rates can positively impact consumer sentiment, fostering optimism and confidence in the economy, which can further stimulate spending and investment.

Interest Rate and Buying Real Estate

Buy, Interest

In recent years, the real estate market has seen fluctuations in interest rates, leaving many prospective homebuyers wondering how to navigate the challenge of purchasing a home amidst higher interest rates. While higher interest rates can make homeownership seem daunting,..